Emergency Medical Travel Insurance – Most or all of the products presented here come from our partners who compensate us. This influences what products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinion is our opinion. Here’s a list of our partners and here’s how we make money.

If you are looking for an insurance policy that protects you against unexpected illness or injury while traveling abroad, you need to find out about travel medical insurance for yourself. This type of insurance may be available through the benefits of some premium travel credit cards, but coverages may be limited and low value.

Emergency Medical Travel Insurance

Emergency medical coverage is included in some comprehensive travel insurance policies, but can also be purchased on its own. Even if you have a basic US insurance plan, including Medicaid or Medicare, it will likely help you very little (or often not at all) when you are outside the country.

What You Need To Know About Travel Insurance

Checking all the different sources of information can get confusing, and it’s easy to misunderstand what type of medical insurance you have when traveling or accidentally duplicate your coverage by purchasing a policy when you already have these benefits. from another source. Here’s everything you need to know about travel medical insurance so you can choose the best option for your trip.

Travel medical insurance covers emergency medical expenses, including medical evacuation, during your trip. These policies do not cover everyday expenses.

So if you break your leg while on vacation abroad, emergency medical care will protect you. However, if you decide to have your teeth cleaned abroad, you will not be covered. Travel medical insurance is designed to protect you in the event of an emergency.

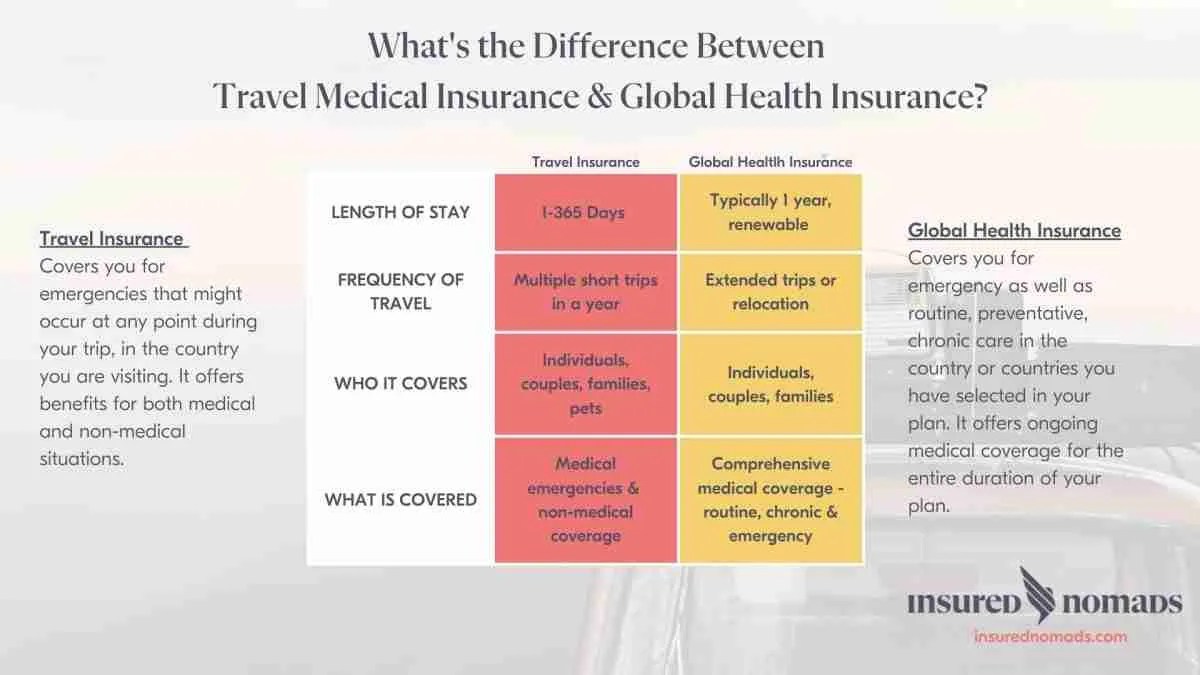

Expats, frequent business travelers, or individuals spending extended periods outside the United States can purchase a comprehensive travel health insurance policy for long-term travelers (more information below). These policies provide normal medical service to those living abroad (usually for a year or more) rather than those on vacation. Long-term international travel health insurance policies should not be confused with travel medical insurance.

What To Do In A Medical Emergency

Travel medical insurance products and comprehensive insurance policies may also include coverage for your family members traveling with you, or coverage for a family member to visit you if you go to hospital. The definition of “family” can vary, but it often includes your spouse, children, siblings, parents, grandparents and more. So, if your traveling companion becomes ill or injured during the trip, trip cancellation benefits may be paid. Or if you go to the hospital in a foreign country, the insurer may pay for flight and hotel costs for a designated family member to come visit you.

Although natural disasters that affect your plans are usually covered, travel medical insurance policies often exclude pandemics from coverage. Since the World Health Organization declared the coronavirus a pandemic on March 11, 2020, plans with pandemic-related exclusions may not cover emergencies related to COVID-19. Some travel insurance companies also exclude from coverage countries that have a Level 4 “Do Not Travel” advisory issued by the U.S. Department of State. If U.S. citizens travel to these countries, travel medical insurance services may not be available. It’s important to check the fine print of your policy to determine what may or may not be covered.

A comprehensive travel insurance policy will include more protections than standalone travel medical insurance. Travel medical insurance plans will offer protections related to emergency medical events, while comprehensive travel insurance policies will cover everything from medical treatment to trip cancellation. Although travel medical plans may include coverage for benefits such as trip interruption, the amounts covered will generally be limited.

With travel medical insurance, there is no trip cancellation benefit, so the cost of the trip does not matter. This makes the policy cheaper than purchasing comprehensive travel insurance, where you will need to include the full cost of your non-refundable holiday when calculating your quote. With a comprehensive package, the higher the cost of the trip, the higher the premium.

Travel Insurance In India, Overseas, International Travel Insurance Policy Online

You will be reimbursed for unexpected emergency medical expenses you incur during your trip. We reviewed a number of travel medical insurance plans on InsureMyTrip and found that they offer the following protections:

You have suffered a head injury and need to be airlifted to a medical facility in a nearby city. Evacuation must be ordered by a doctor.

You are in a foreign country, you don’t speak the language and you need to find a doctor. If you call the emergency helpline, your insurer will help you find a doctor.

You were flown to a hospital in a nearby town to receive medical treatment. Medical treatment has been completed and you must now be airlifted to or back from where you were evacuated from home.

Infographic: Covid Challenging Your Travel Plans? Good News! Tugo Travel Insurance Has Got You And Your Visitors Covered

Your luggage was lost by the airline and you need to buy toiletries and clothes. There is usually a financial cap for each item purchased.

In the table above, for each service, we have included an example of the event in question. We’ve also listed the amount of coverage you can expect for each benefit. Coverage limits depend on the policy you choose. Since we have reviewed several policies, these limits have a wide range.

The main areas of coverage in most plans are emergency medical expenses, medical evacuation, and accidental death or dismemberment. Although these limits are high, many of them will only apply once you submit a claim to your primary medical insurer. Before you can submit a claim to your travel medical insurer, you need to know what type of policy you have.

The type of trip and type of coverage determine which travel medical policy makes the most sense. You will need to familiarize yourself with four terms: primary coverage, secondary coverage, single trip, and multiple trip.

What Is Group Travel Insurance? How Do The Plans Work? (2023)

Travel medical insurance plans will designate medical coverage as primary or secondary. Primary means you can submit a claim to your travel medical insurance company before submitting it to any other insurer. When the policy is secondary, you will need to submit your claim to your primary insurer before you can submit a claim to the travel insurer.

For example, let’s say you break your leg on vacation and need to go to the emergency room immediately. If your travel health insurance is basic, you can pay your medical bill with your credit card and then file a claim directly with the travel insurer.

However, if your travel medical coverage is secondary, you will need to submit this claim to your US medical insurer first, although they may deny it (as policies limit coverage overseas). You may even need to attach your primary insurance denial notice to your claim with your secondary travel insurer.

Whether you’re a frequent traveler or only vacation once a year, you can choose a policy that suits your travel needs. You can purchase a service for one or more trips, and it is important to know the difference between the two types.

Health Insurance Options In Germany

Multi-trip coverage makes sense (and is generally more cost-effective) if you travel often and don’t want to purchase a policy every time you take an international trip. However, if you do not have medical insurance in the United States, you will not be covered by multi-trip plans.

Do I need to have basic health insurance in the United States to be eligible for travel medical insurance?

The answer to this question is: maybe. It depends on the type of coverage you have. If your unique travel plan lists your medical coverage as primary, you do not need another health insurance policy. However, if the coverage provided in your single travel contract is secondary, then you must have primary health insurance.

You can search for medical travel policies on insurance comparison sites such as SquareMouth (partner), InsureMyTrip or Travel Guard. Policies vary by state and availability may change during or after the pandemic, so check to see if the state you live in offers travel medical insurance in light of the coronavirus.

Free Business Travel Insurance: Now On Payhawk Corporate Visa Cards In The Eea

If you are planning to travel and your current medical insurance does not cover you in the country you are traveling to, it may be a good idea to purchase travel medical insurance. You can either purchase a comprehensive travel insurance policy or one that only provides a medical service.

Purchasing an insurance policy strictly for travel medical insurance is a good idea for those who want to receive emergency care while traveling, but:

If you don’t have a travel card that offers adequate trip cancellation benefits and also want emergency medical care, it’s best to purchase a comprehensive travel insurance policy.

We searched InsureMyTrip for a month-long trip to Costa Rica in June 2023 for a 30-year-old male, and found the following unique travel policy:

When Travel Insurance Covers Medical Emergency Expenses

Although we only got one result for this search, $30.30 is about the average price you’re likely to see for basic travel medical insurance for a trip of this nature. In fact, travel medical insurance does not include trip cancellation benefits.

If you were looking for a policy that provides comprehensive travel insurance, the price

Travel insurance emergency medical expenses, emergency medical evacuation travel insurance, emergency medical travel insurance only, international travel emergency medical insurance, allianz emergency medical travel insurance, emergency medical travel insurance for seniors, travel insurance for emergency medical only, emergency medical insurance for international travel, best emergency medical travel insurance, emergency medical travel insurance canada, american express emergency medical travel insurance, manulife emergency medical travel insurance