Navigating the complexities of insurance can be daunting, but understanding ohio insurance rates is crucial for making informed decisions. This guide delves into the intricacies of insurance rates in Ohio, providing valuable insights to help consumers secure the best coverage at the most competitive prices.

Our comprehensive analysis compares rates across different companies, analyzes the impact of various factors, and explores the regulations in place to protect consumers. Whether you’re a new driver or an experienced policyholder, this guide empowers you with the knowledge to make informed choices about your insurance needs.

Ohio Insurance Rate Data

Ohio insurance rate data is widely available and accessible to the public. Various sources provide accurate and up-to-date information on insurance rates, including the Ohio Department of Insurance, insurance companies, and independent insurance agencies.

Sources for Rate Information

The Ohio Department of Insurance maintains a comprehensive database of insurance rates for various types of insurance, including auto, home, and health insurance. Insurance companies are required to file their rates with the department, which are then made available to the public through the department’s website or upon request.

Insurance companies also provide rate information on their websites and through their agents. They can provide quotes for specific policies based on individual factors such as age, location, and driving history.

Independent insurance agencies represent multiple insurance companies and can provide rate comparisons from different carriers. They can assist individuals in finding the most competitive rates for their insurance needs.

Factors Influencing Accessibility, Ohio insurance rates

The accessibility of insurance rate data in Ohio is influenced by several factors, including:

- Type of Insurance:Rate information for auto insurance is generally more accessible than for other types of insurance, such as health or life insurance.

- Data Format:Rate data may be available in different formats, such as spreadsheets, databases, or online portals. The availability of data in a user-friendly format can impact its accessibility.

- Technology:The use of technology has made insurance rate data more accessible through online platforms and mobile applications.

Rate Comparison and Analysis

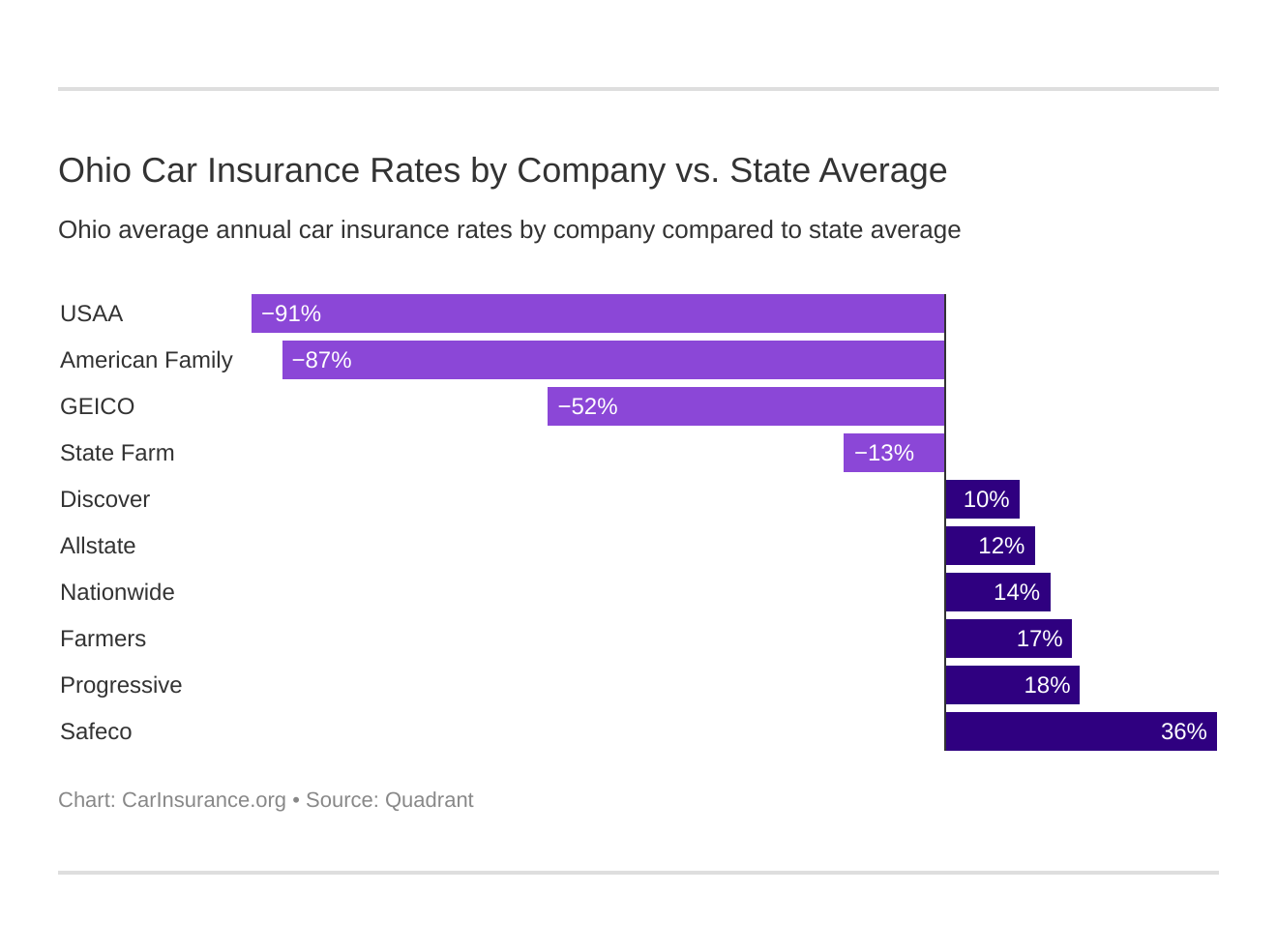

Understanding the insurance landscape in Ohio requires a thorough examination of insurance rates across different companies. This analysis considers the impact of coverage type, deductibles, and policy limits on premiums. By comparing rates and identifying trends, consumers can make informed decisions about their insurance coverage.

Company Rate Comparison

Insurance rates vary significantly among different insurance companies in Ohio. Factors such as financial stability, claims history, and underwriting guidelines influence the pricing strategies of each company. By comparing quotes from multiple insurers, consumers can identify the most competitive rates for their specific needs.

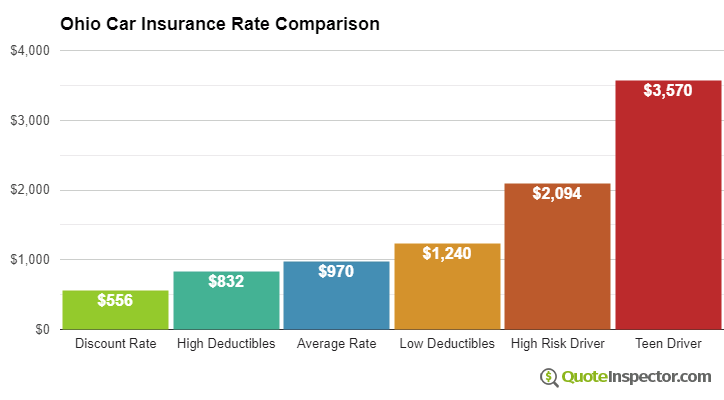

Coverage Type and Deductibles

The type of coverage selected significantly impacts insurance rates. Comprehensive coverage, which includes collision and theft protection, typically costs more than liability-only coverage. Additionally, higher deductibles lower premiums. However, choosing a higher deductible may increase out-of-pocket expenses in the event of a claim.

Policy Limits

Policy limits determine the maximum amount of coverage provided by an insurance policy. Higher policy limits result in higher premiums. Consumers should carefully consider their risk tolerance and financial situation when selecting policy limits.

Rate Trends and Patterns

Insurance rates are not static and can fluctuate over time. Factors such as economic conditions, claims experience, and regulatory changes can influence rate trends. By monitoring rate patterns, consumers can anticipate potential changes and adjust their insurance coverage accordingly.

Factors Affecting Rates

Determining auto insurance rates in Ohio involves a careful consideration of various factors. These factors play a crucial role in assessing the risk associated with insuring a particular driver and vehicle, thereby influencing the premium amount.

Let’s explore some of the key factors that insurance companies in Ohio take into account when calculating insurance rates:

Driving History

Your driving history is a significant indicator of your risk level as a driver. Insurance companies examine your driving record for any traffic violations, accidents, or claims you may have had. A clean driving history with no major incidents typically results in lower insurance rates, while a history of accidents or traffic violations can lead to higher premiums.

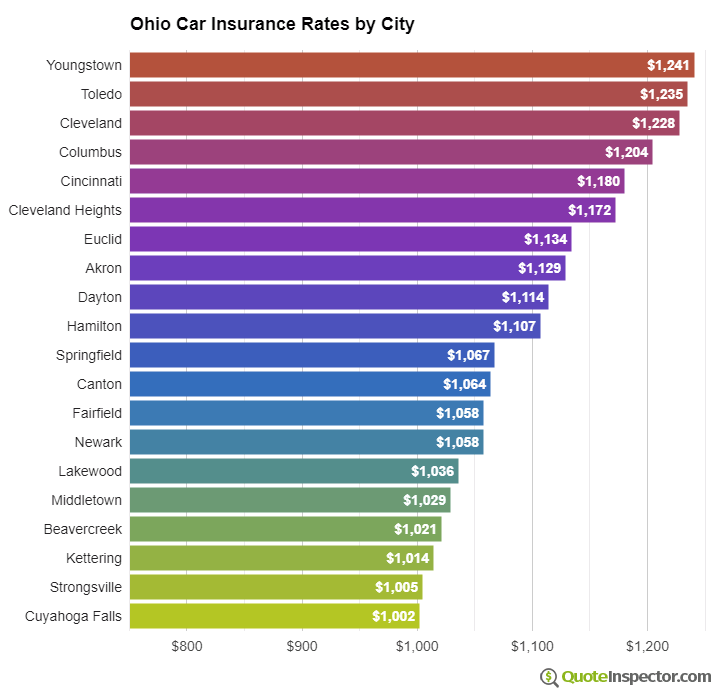

Location

Where you live can also impact your insurance rates. Insurance companies consider factors such as population density, crime rates, and accident frequency in your area. Generally, drivers living in urban areas with higher population density and traffic congestion tend to pay higher insurance premiums compared to those living in rural areas.

Age

Age is another important factor that influences insurance rates. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. As a result, they often pay higher insurance premiums compared to older, more experienced drivers.

Credit Score

In Ohio, insurance companies are allowed to use credit-based insurance scores to determine insurance rates. A higher credit score generally indicates a lower risk of filing claims, leading to lower insurance premiums. Conversely, a lower credit score can result in higher insurance rates.

Consumer Protections

Ohio has implemented regulations and laws to safeguard consumers against unfair or excessive insurance rates. These measures empower consumers to seek assistance and file complaints if they suspect overcharging.

The Ohio Department of Insurance (ODI) plays a pivotal role in enforcing these regulations. Consumers can reach out to the ODI to report concerns or file formal complaints. The ODI thoroughly investigates each complaint and takes appropriate actions to resolve any issues.

Filing Complaints

Filing a complaint with the ODI is a straightforward process. Consumers can either submit a written complaint or file online through the ODI’s website. The complaint should include detailed information about the insurance company, the policy in question, and the reasons for the complaint.

The ODI will acknowledge receipt of the complaint and initiate an investigation promptly.

Consumer Assistance

In addition to filing complaints, consumers can also seek assistance from the ODI. The ODI provides various resources and guidance to help consumers understand their insurance policies and rights. Consumers can contact the ODI’s consumer assistance hotline or visit their website for information and support.

Insurance Market Dynamics

The insurance market in Ohio is highly competitive, with numerous insurance companies vying for market share. This competition has led to a wide range of insurance products and services, as well as competitive rates. The market is also regulated by the Ohio Department of Insurance, which ensures that insurance companies operate fairly and in the best interests of consumers.

New technologies and innovations are also having a significant impact on the insurance industry in Ohio. These technologies are making it easier for insurance companies to collect and analyze data, which is leading to more accurate and personalized insurance rates.

They are also making it easier for consumers to shop for and compare insurance rates, which is helping to drive down costs.

Insurance Brokers and Agents

Insurance brokers and agents play an important role in the Ohio insurance market. They help consumers find the right insurance coverage for their needs and budget. They can also help consumers file claims and resolve disputes with insurance companies.

Ultimate Conclusion: Ohio Insurance Rates

In the dynamic insurance market of Ohio, staying informed about rates is essential. By understanding the factors that influence costs, consumers can make strategic decisions to minimize premiums while maximizing coverage. This guide serves as a valuable resource, empowering Ohio residents to navigate the insurance landscape with confidence and secure the best possible rates for their unique needs.

Essential Questionnaire

What factors influence insurance rates in Ohio?

Insurance rates in Ohio are determined by various factors, including driving history, location, age, and credit score.

How can I compare insurance rates from different companies in Ohio?

You can compare insurance rates from different companies in Ohio by using online comparison tools or contacting insurance agents.

What regulations are in place to protect consumers from unfair insurance rates?

Ohio has regulations in place to protect consumers from unfair or excessive insurance rates, including the Ohio Department of Insurance.