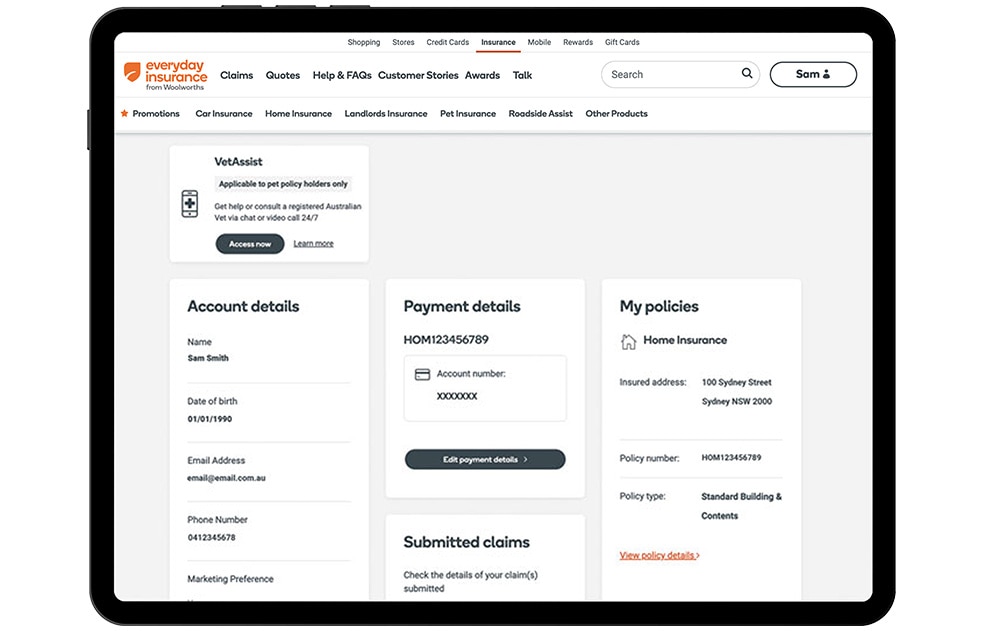

Introducing My Insurance Portal, your gateway to a seamless and secure insurance experience. Designed as a centralized platform, it empowers you with instant access to your policies, claims, and billing information, transforming insurance management into a breeze.

From policy management and claims processing to real-time billing updates, our portal streamlines every aspect of your insurance journey, providing you with unparalleled convenience and peace of mind.

Introduction

In today’s fast-paced world, managing multiple insurance policies can be a daunting task. A personal insurance portal is a centralized platform that provides a comprehensive solution for managing all your insurance needs in one convenient location. With a user-friendly interface and a range of valuable features, a personal insurance portal empowers you to stay organized, make informed decisions, and ensure that you have the right coverage for your specific circumstances.

Benefits of a Centralized Platform

Having all your insurance information in one place offers numerous advantages. It provides you with a clear overview of your policies, coverage limits, and premiums, allowing you to track your insurance expenses and make adjustments as needed. By eliminating the need to search through multiple documents or contact different insurance companies, a personal insurance portal saves you time and effort, making it easier to manage your insurance portfolio.

Features of an Insurance Portal

Insurance portals are online platforms that provide a convenient and efficient way for policyholders to manage their insurance policies, file claims, and make payments. They offer a range of features that can benefit both individuals and businesses.

Common Features

Some of the most common features of insurance portals include:

| Feature | Description | Benefits | Example |

|---|---|---|---|

| Policy Management | Allows policyholders to view their policy details, make changes, and download copies. | Simplifies policy management and reduces the need for paper documentation. | Viewing policy details, updating beneficiaries, and printing ID cards. |

| Claims Processing | Provides a platform for policyholders to submit claims, track their status, and receive updates. | Streamlines the claims process and reduces the time it takes to receive payment. | Filing claims online, uploading supporting documents, and monitoring claim progress. |

| Billing | Allows policyholders to view their billing statements, make payments, and set up automatic payments. | Simplifies the payment process and reduces the risk of late payments. | Viewing invoices, making online payments, and scheduling recurring payments. |

Security and Privacy Considerations

Data security and privacy are crucial for insurance portals. Sensitive personal and financial information is processed and stored, making it essential to safeguard against unauthorized access, breaches, and misuse.

When choosing an insurance portal, consider these tips to ensure strong security measures:

Authentication and Authorization

- Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of identification, such as a code sent to your phone.

- Role-based access controls restrict access to sensitive information based on user roles and permissions.

Data Encryption

Encryption ensures that data is protected from unauthorized access, even if it is intercepted. Look for portals that use industry-standard encryption algorithms.

Compliance with Regulations, My insurance portal

Insurance portals must comply with regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) to protect sensitive data.

Regular Security Audits

Regular security audits identify vulnerabilities and ensure that security measures are up to date.

Transparency and Communication

Transparency in security practices and prompt communication of any security incidents build trust and protect users.

Integration with Other Services

Integrating insurance portals with other financial and healthcare services offers numerous benefits, enhancing the user experience and providing a comprehensive platform for managing various aspects of personal finances and well-being.

By seamlessly connecting insurance portals with banking, investment, and healthcare platforms, individuals can access a consolidated view of their financial and health information. This integration eliminates the need to navigate multiple platforms and manually enter data, saving time and reducing errors.

Benefits of Integration

- Streamlined financial management: Integration with banking services allows users to pay insurance premiums, track expenses, and manage investments in one place.

- Personalized health recommendations: Connection with healthcare platforms enables personalized health recommendations, reminders, and access to medical records, improving health outcomes.

- Improved customer service: Integration facilitates seamless communication between insurance providers, healthcare professionals, and financial advisors, enhancing customer support and resolving queries efficiently.

User Experience and Accessibility

Creating a user-friendly and accessible insurance portal is crucial for providing a seamless experience to users. By prioritizing these aspects, insurance providers can ensure that their portals are easy to navigate, understand, and accessible to individuals with disabilities.

To achieve this, insurance portals should employ clear and concise language, avoiding jargon and technical terms that may be unfamiliar to users. The layout should be well-organized and intuitive, with easy-to-find navigation menus and search functionality. Additionally, the portal should be responsive, adapting to different screen sizes and devices for optimal viewing.

Accessibility Features

- Providing closed captions and transcripts for videos and audio content.

- Using alternative text to describe images for visually impaired users.

- Ensuring the portal is compatible with assistive technologies, such as screen readers.

- Offering keyboard navigation options for users who may not be able to use a mouse.

- Using high-contrast color schemes and adjustable font sizes to enhance readability.

Future Trends in Insurance Portals: My Insurance Portal

Insurance portals are rapidly evolving to meet the changing needs of policyholders. Emerging technologies and trends are shaping the future of these portals, offering new opportunities to improve the customer experience and streamline insurance processes.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming the insurance industry by automating tasks, improving risk assessment, and personalizing customer experiences. AI-powered chatbots provide 24/7 support, while ML algorithms analyze data to identify patterns and predict risks, leading to more accurate and personalized insurance premiums.

Blockchain Technology

Blockchain technology is gaining traction in the insurance sector, offering enhanced security and transparency. Blockchain-based portals can store and manage insurance contracts securely, reducing fraud and streamlining claims processing.

Wearable Devices and Telematics

Wearable devices and telematics systems collect data on policyholders’ health, driving habits, and other factors. This data can be used to provide personalized insurance plans, rewards for healthy behaviors, and usage-based insurance premiums.

Personalized Insurance

Future insurance portals will offer highly personalized experiences tailored to individual needs and preferences. By leveraging data analytics and AI, portals can provide customized insurance plans, recommendations, and risk management advice.

Seamless Integration with Other Services

Insurance portals will seamlessly integrate with other services, such as financial management apps, healthcare providers, and ride-sharing platforms. This integration will provide a comprehensive view of policyholders’ financial and health information, enabling tailored insurance solutions and proactive risk management.

Closing Notes

With My Insurance Portal, you gain complete control over your insurance affairs. Its intuitive design and robust security measures ensure a user-friendly and protected experience. As the insurance landscape continues to evolve, our portal will remain at the forefront, embracing emerging technologies to enhance your insurance experience.