Errors and omissions insurance washington state – In the professional landscape of Washington State, errors and omissions insurance (E&O) stands as a crucial safeguard for individuals and businesses against financial and reputational risks. This comprehensive guide delves into the intricacies of E&O insurance, exploring its purpose, coverage, importance, and essential considerations for professionals in the state.

E&O insurance provides a safety net against claims arising from unintentional errors, omissions, or negligence in the performance of professional services. It offers peace of mind, knowing that unforeseen circumstances and potential liabilities are adequately addressed.

Overview of Errors and Omissions Insurance in Washington State

Errors and omissions insurance (E&O), also known as professional liability insurance, protects professionals from financial losses resulting from mistakes, errors, or omissions in their professional services.

In Washington State, E&O insurance is particularly important for professionals who provide advice, guidance, or services to clients, such as accountants, attorneys, architects, engineers, financial advisors, insurance agents, real estate agents, and healthcare providers.

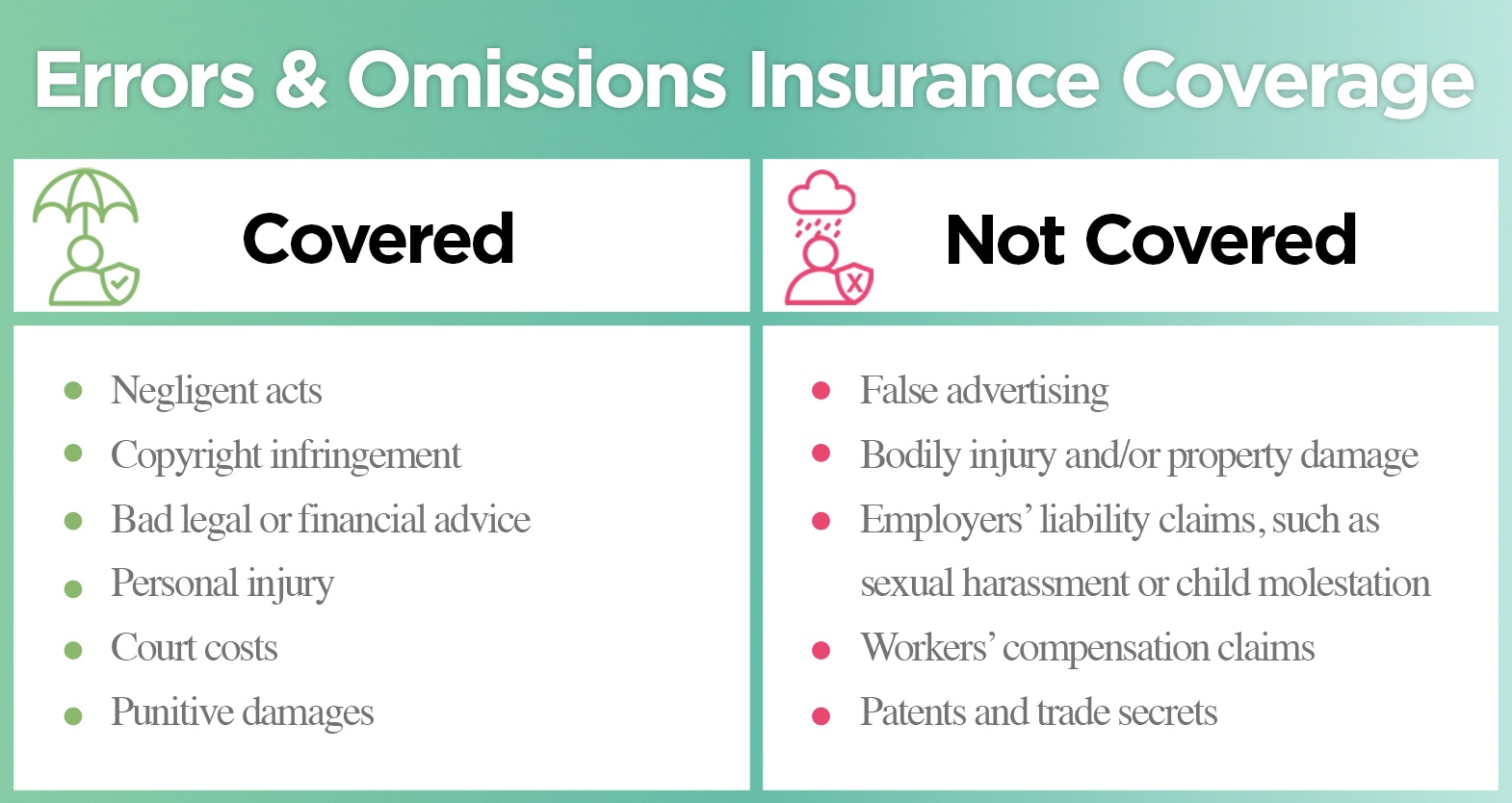

Coverage Typically Included in E&O Policies in Washington State

E&O policies in Washington State typically provide coverage for the following:

- Negligence, errors, or omissions in professional services

- Breach of contract

- Misrepresentation or misadvice

- Defamation, slander, or libel

- Intellectual property infringement

Common Errors and Omissions Covered by Insurance in Washington State

Errors and omissions (E&O) insurance in Washington State provides coverage for professionals who make mistakes or omissions in their work. These mistakes can lead to financial losses for clients, and E&O insurance can help protect professionals from these losses.

Common errors and omissions that are covered by E&O insurance in Washington State include:

- Negligence:This is the most common type of error or omission covered by E&O insurance. Negligence occurs when a professional fails to exercise the proper level of care in their work, resulting in damages to a client.

- Breach of contract:This occurs when a professional fails to fulfill their obligations under a contract with a client. This can include failing to complete a project on time, failing to meet the agreed-upon specifications, or failing to provide the promised services.

- Misrepresentation:This occurs when a professional makes a false or misleading statement to a client. This can include misrepresenting the professional’s qualifications, experience, or the services that they will provide.

- Omissions:This occurs when a professional fails to disclose important information to a client. This can include failing to disclose a conflict of interest, failing to disclose a material fact, or failing to warn a client of a potential risk.

The types of claims that are typically covered by E&O insurance in Washington State include:

- Financial losses:This is the most common type of claim covered by E&O insurance. Financial losses can include lost profits, lost revenue, and legal expenses.

- Reputational damage:This occurs when a professional’s reputation is damaged as a result of an error or omission. This can include damage to the professional’s reputation in the community, damage to the professional’s reputation with clients, or damage to the professional’s reputation with other professionals.

- Emotional distress:This occurs when a professional’s error or omission causes emotional distress to a client. This can include anxiety, depression, or other mental health problems.

The limits of coverage and exclusions that may apply to E&O insurance policies in Washington State vary depending on the policy. It is important to carefully review the policy before purchasing it to ensure that it provides the coverage that you need.

The Importance of E&O Insurance for Professionals in Washington State

Errors and omissions (E&O) insurance is a type of professional liability insurance that protects businesses and individuals from financial losses resulting from mistakes, errors, or omissions in the performance of their professional services. In Washington State, E&O insurance is crucial for professionals in various industries who provide advice, services, or products to clients.

The risks and liabilities that professionals face in Washington State vary depending on their industry and the nature of their work. However, some common risks include:

- Providing negligent advice or services that result in financial losses for clients

- Failing to meet contractual obligations

- Making errors or omissions in professional documents

- Breaching confidentiality or privacy agreements

- Failing to properly supervise employees or subcontractors

The potential financial and reputational consequences of not having E&O insurance in Washington State can be significant. If a professional is sued for negligence or breach of contract, they may be held liable for damages, legal fees, and other expenses.

In addition, a professional’s reputation can be damaged if they are found to have made errors or omissions in their work.

E&O insurance can provide professionals with peace of mind and financial protection against these risks. By having E&O insurance, professionals can focus on providing high-quality services to their clients without worrying about the potential financial consequences of mistakes or omissions.

Industries and Professions that Benefit from E&O Insurance in Washington State

E&O insurance is beneficial for a wide range of industries and professions in Washington State. Some of the industries and professions that are most likely to benefit from E&O insurance include:

- Accountants

- Architects and engineers

- Attorneys

- Consultants

- Contractors

- Financial advisors

- Healthcare professionals

- Insurance agents

- Real estate agents

- Technology professionals

If you are a professional in Washington State, it is important to consider purchasing E&O insurance to protect yourself from the financial and reputational risks associated with your work.

Choosing the Right E&O Insurance Policy in Washington State

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)

Selecting the appropriate E&O insurance policy in Washington State requires careful consideration of several factors. These include the nature of your profession, the potential risks associated with your services, and the coverage limits and exclusions that best align with your needs.

Types of E&O Insurance Policies

Various types of E&O insurance policies are available in Washington State, each tailored to specific professions and industries. Common options include:

- Professional liability insurance

- Errors and omissions insurance

- Cyber liability insurance

- Directors and officers liability insurance

Comparing Quotes and Coverage Options

To ensure you secure the most suitable E&O insurance policy, it’s crucial to compare quotes and coverage options from multiple insurance providers. This allows you to assess the premium costs, coverage limits, deductibles, and exclusions offered by each insurer. By evaluating these factors, you can make an informed decision that meets your specific requirements.

Filing a Claim for Errors and Omissions Insurance in Washington State

Filing a claim for errors and omissions (E&O) insurance in Washington State involves several steps and requires specific documentation. Understanding the process and gathering the necessary information can help ensure a smooth and successful claim experience.

Process for Filing a Claim

To file a claim for E&O insurance in Washington State, you should:

Notify your insurance provider promptly

Report the error or omission to your insurance company as soon as possible.

Provide a written notice of claim

Submit a formal written notice of claim to your insurer within the time frame specified in your policy.

Gather supporting documentation

Collect and organize relevant documentation to support your claim, such as client contracts, communication records, and expert reports.

Submit your claim

Submit your claim form and supporting documentation to your insurance provider for review.

Documentation Required, Errors and omissions insurance washington state

The documentation typically required to support an E&O insurance claim in Washington State includes:

Policy details

A copy of your E&O insurance policy.

Claim form

A completed claim form provided by your insurance provider.

Description of the error or omission

A detailed account of the alleged error or omission, including the date, nature, and consequences.

Documentation of damages

Evidence of the damages or losses incurred as a result of the error or omission, such as client invoices, repair bills, or legal settlements.

Communication records

Emails, letters, or other communication related to the error or omission.

Expert reports

If applicable, reports from independent experts or professionals who can provide an opinion on the error or omission.

Timelines and Procedures

The timelines and procedures for processing E&O insurance claims in Washington State vary depending on the insurance provider and the specific circumstances of the claim. However, some general guidelines include:

Time limits

Most E&O insurance policies have specific time limits for filing a claim. It is crucial to report the error or omission and submit your claim within these time frames.

Investigation

The insurance provider will investigate the claim to determine coverage and liability. This may involve reviewing documentation, interviewing witnesses, and consulting with experts.

Settlement

If the claim is approved, the insurance provider will negotiate a settlement with you. The settlement amount will depend on the terms of your policy and the extent of the damages.

Last Recap: Errors And Omissions Insurance Washington State

In conclusion, errors and omissions insurance is an indispensable tool for professionals in Washington State, providing a robust defense against financial and reputational setbacks. By carefully evaluating coverage options and understanding the nuances of the claims process, professionals can ensure they have the necessary protection to navigate the complexities of their respective fields with confidence.

Top FAQs

What are the common types of claims covered by E&O insurance in Washington State?

E&O insurance typically covers claims related to negligence, errors in judgment, omissions, and breach of contract in the provision of professional services.

Who should consider purchasing E&O insurance in Washington State?

Professionals in various industries, including healthcare, legal, financial services, real estate, and consulting, are strongly advised to consider E&O insurance.

What are the key factors to consider when choosing an E&O insurance policy in Washington State?

Factors to consider include coverage limits, deductibles, exclusions, claims history, and the reputation of the insurance provider.